Date: 30 Oct 2023

Agro Chemicals

Sector |

Market Cap |

No of Companies |

Agro Chemicals |

169032.11 |

28 |

NetWorth |

21846.61 |

TTM Sales |

82142.36 |

TTM Sales Var (%) |

5.41 |

Debt |

3242.96 |

TTM OP |

13725.09 |

TTM NP Var (%) |

-6.36 |

Capital Employed |

25798.20 |

TTM OPM (%) |

18.16 |

EV/TM Sales |

2.06 |

Net Block |

9535.09 |

TTM PATM (%) |

7.28 |

EV/TTM EBITDA |

12.30 |

Current Assets |

21180.14 |

Debt / Equity |

0.15 |

P/E |

28.28 |

ROCE (%) |

119.62 |

RONW (%) |

27.36 |

P/B |

7.74 |

The above figures are in Rs. Crores as of 30 Oct 2023

TTM ended June 2023

|

30 Oct 2023 |

30 Sep 2022 |

30 Sep 2021 |

MoM Var. (%) |

YoY Var. (%) |

Sector Marketcap |

169032.11 |

183965.8 |

186260.36 |

-8.12 |

-9.25 |

Total Marketcap |

31296445.71 |

27317926.84 |

26175669.95 |

14.56 |

19.56 |

Sector's share |

0.54 |

0.67 |

0.71 |

-0.13 |

-0.17 |

Sector No of companies |

28 |

25 |

25 |

3 |

3 |

Total Listed companies |

4442 |

4183 |

4061 |

259 |

381 |

Sector's share |

0.63 |

0.6 |

0.62 |

0.03 |

0.01 |

Nifty 50 |

19140.9 |

19638.3 |

18012.2 |

-2.53 |

6.27 |

Gainers |

| Company Name |

30/10/2023 |

29/09/2023 |

Var% |

| Dharmaj Crop |

261.65 |

210.00 |

24.60 |

| Bhagiradha Chem. |

1493.50 |

1217.10 |

22.71 |

| Super Crop Safe |

10.24 |

8.73 |

17.30 |

| Punjab Chemicals |

1206.95 |

1105.65 |

9.16 |

| Phyto Chem (I) |

42.35 |

39.00 |

8.59 |

Losers |

| Company Name |

30/10/2023 |

29/09/2023 |

Var% |

| UPL |

538.40 |

616.25 |

-12.63 |

| Sumitomo Chemi. |

381.50 |

422.35 |

-9.67 |

| Astec Lifescienc |

1212.20 |

1336.05 |

-9.27 |

| Bayer Crop Sci. |

4886.05 |

5335.50 |

-8.42 |

| Best Agrolife |

1037.10 |

1123.85 |

-7.72 |

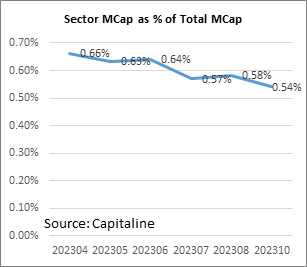

During the month of October 2023, Agro Chemicals sector’s Marketcap decreased -8.12% to Rs 169032.11 crore, compared to 14.56% rise in total listed marketcap to Rs 31296445.71 crore.

Sector’s share of total listed marketcap moved to 0.54% in October 2023 from 0.67% in September 2022 and 0.71% in September 2021.

In terms of price appreciation in the sector, there were 11 gainers and 14 losers in the month of Oct 2023. The gainers accounted for 39.29% of sector companies, losers accounted for 50.00% of sector companies, while 3% remained unchanged.

The top 3 gainers were Dharmaj Crop (24.60% gain), Bhagiradha Chem. (22.71% gain) and Super Crop Safe (17.30% gain).

The 3 losers at the bottom were UPL (-12.63% fall), Sumitomo Chemi. (-9.67% fall) and Astec Lifescienc (-9.27% fall).

During the month Punjab Chemicals & Crop Protection Ltd, Rallis India Ltd, UPL Ltd, NACL Industries Ltd, Sumitomo Chemical India Ltd, Astec Lifesciences Ltd and Sharda Cropchem Ltd announced their results. Of these Rallis India Ltd and UPL Ltd reported rise in net profit attributable to shareholders. Companies like Sumitomo Chemical India Ltd, Punjab Chemicals & Crop Protection Ltd and NACL Industries Ltd reported fall in net profit attributable to shareholders.

Astec Lifesciences Ltd, Sharda Cropchem Ltd and UPL Ltd reported profit to loss.

During the month Bayer CropScience Ltd, Excel Industries Ltd, Punjab Chemicals & Crop Protection Ltd, Rallis India Ltd, Dhanuka Agritech Ltd, UPL Ltd, P I Industries Ltd, Aimco Pesticides Ltd, Bharat Rasayan Ltd, Bhaskar Agrochemicals Ltd, NACL Industries Ltd, Phyto Chem (India) Ltd, Super Crop Safe Ltd, PB Global Ltd, Best Agrolife Ltd, Bhagiradha Chemicals & Industries Ltd, Kilpest India Ltd, Meghmani Organics Ltd(Merged), Shivalik Rasayan Ltd, Sumitomo Chemical India Ltd, Astec Lifesciences Ltd, Insecticides India Ltd, Heranba Industries Ltd, Sharda Cropchem Ltd, Hemani Industries Ltd, Sikko Industries Ltd, India Pesticides Ltd, Meghmani Organics Ltd, Dharmaj Crop Guard Ltd, Aristo Bio-Tech & Lifescience Ltd and Crop Life Science Ltd filed their shareholding patterns.

FIIs increased their shareholding in P I Industries Ltd from 19.17% to 20.01%, Rallis India Ltd from 7.69% to 8.23%, Shivalik Rasayan Ltd from 0.35% to 0.66%, Bayer CropScience Ltd from 3.18% to 3.30%, Kilpest India Ltd from 3.06% to 3.16%, Sumitomo Chemical India Ltd from 2.51% to 2.58%, Punjab Chemicals & Crop Protection Ltd from 2.97% to 2.98% and Sharda Cropchem Ltd from 2.00% to 2.01%. FIIs reduced their shareholding in Excel Industries Ltd from 0.73% to 0.70%, India Pesticides Ltd from 0.38% to 0.33%, NACL Industries Ltd from 1.16% to 1.03%, Meghmani Organics Ltd from 1.50% to 1.34%, Astec Lifesciences Ltd from 1.95% to 1.33%, Dharmaj Crop Guard Ltd from 5.01% to 4.37%, Insecticides India Ltd from 6.02% to 5.19%, Best Agrolife Ltd from 10.83% to 9.86%, Dhanuka Agritech Ltd from 3.55% to 2.21% and UPL Ltd from 37.96% to 33.56%.

DIIs increased their shareholding in UPL Ltd from 14.02% to 16.57%, Dhanuka Agritech Ltd from 17.24% to 18.22%, Sumitomo Chemical India Ltd from 5.08% to 5.64%, Rallis India Ltd from 13.52% to 13.90%, Bayer CropScience Ltd from 13.01% to 13.21%, NACL Industries Ltd from 0.81% to 0.96%, Meghmani Organics Ltd from 0.00% to 0.04%, India Pesticides Ltd from 1.59% to 1.61% and Astec Lifesciences Ltd from 9.14% to 9.15%. DIIs reduced their shareholding in Excel Industries Ltd from 6.93% to 6.92%, Sharda Cropchem Ltd from 12.46% to 12.29%, Heranba Industries Ltd from 0.65% to 0.02%, P I Industries Ltd from 22.93% to 22.11% and Insecticides India Ltd from 10.47% to 9.29%.

Promoters increased their shareholding in Rallis India Ltd from 50.09% to 55.08%. Promoters reduced their shareholding in Astec Lifesciences Ltd from 66.76% to 66.75%, Meghmani Organics Ltd from 49.50% to 49.32%, Super Crop Safe Ltd from 38.71% to 38.30%, Shivalik Rasayan Ltd from 50.05% to 47.95% and India Pesticides Ltd from 67.20% to 63.61%.

During the month Annual reports of Bayer CropScience Ltd, Excel Industries Ltd, Punjab Chemicals & Crop Protection Ltd, Rallis India Ltd, Dhanuka Agritech Ltd, UPL Ltd, P I Industries Ltd, Aimco Pesticides Ltd, Bharat Rasayan Ltd, Savoy Herbals Ltd (Wound-up), Bhaskar Agrochemicals Ltd, NACL Industries Ltd, Phyto Chem (India) Ltd, Super Crop Safe Ltd, PB Global Ltd, Best Agrolife Ltd, Syngenta India Pvt Ltd, Indofil Industries Ltd, Hindustan Insecticides Ltd, Bhagiradha Chemicals & Industries Ltd, Kilpest India Ltd, Gharda Chemicals Ltd, Shivalik Rasayan Ltd, Cheminova India Ltd, Sumitomo Chemical India Ltd, Gujarat Insecticides Ltd, Sulphur Mills Ltd, Arysta Lifescience India Ltd, Tagros Chemicals India Pvt Ltd, Tropical Agrosystem (India) Pvt Ltd, SWAL Corporation Ltd, Astec Lifesciences Ltd, Insecticides India Ltd, Akola Chemicals India Ltd, Ravi Organics Ltd, Heranba Industries Ltd, Bharat Insecticides Ltd, Kaiser Industries Ltd, Biostadt India Ltd, Krishi Rasayan Exports Pvt Ltd, BDA Agrochem Pvt Ltd, GSP Crop Science Pvt Ltd, Johnson Matthey Chemicals India Pvt Ltd, Sharda Cropchem Ltd, Gaiagen Technologies Pvt Ltd, Maharashtra Pesticide Ltd, HPM Chemicals & Fertilizers Ltd, Spectrum Ethers Pvt Ltd, FIL Industries Ltd, Hemani Industries Ltd, Biotech International Limited, Advance Cropcare India Pvt Ltd, Atul Crop Care Ltd, Crystal Crop Protection Ltd, Deccan Fine Chemicals India Pvt Ltd, Parijat Industries (India) Pvt Ltd, Agrico Organics Ltd, Aero Agro Chemical Industries Ltd, Godvet Agrochem Ltd, Parry Agrochem Exports Ltd, Devgen Seeds & Crop Technology Pvt Ltd, Bayer Vapi Pvt Ltd, Behram Chemicals Pvt Ltd, Sikko Industries Ltd, Krishi Rasayan Pvt Ltd, SCM Fertichem Ltd, Yara Fertilisers India Pvt Ltd, Rainbow Crop Health Ltd, Jivagro Ltd, India Pesticides Ltd, Meghmani Organics Ltd, Dharmaj Crop Guard Ltd, Aristo Bio-Tech & Lifescience Ltd, Samarthman Agro Chem Ltd, Crop Life Science Ltd, R 3 Crop Care Pvt Ltd and Netmatrix Crop Care Pvt Ltd were updated in Capitaline.