Date: 30 Aug 2024

Aerospace & Defence

Sector |

Market Cap |

No of Companies |

Aerospace & Defence |

840257.55 |

22 |

NetWorth |

63298.32 |

TTM Sales |

72345.77 |

TTM Sales Var (%) |

13.82 |

Debt |

3476.44 |

TTM OP |

19158.06 |

TTM NP Var (%) |

37.38 |

Capital Employed |

82669.39 |

TTM OPM (%) |

31.47 |

EV/TM Sales |

11.61 |

Net Block |

22273.56 |

TTM PATM (%) |

21.02 |

EV/TTM EBITDA |

41.79 |

Current Assets |

121291.32 |

Debt / Equity |

0.05 |

P/E |

55.24 |

ROCE (%) |

91.90 |

RONW (%) |

24.03 |

P/B |

13.27 |

The above figures are in Rs. Crores as of 30 Aug 2024

TTM ended June 2024

|

30 Aug 2024 |

31 Jul 2023 |

31 Jul 2022 |

MoM Var. (%) |

YoY Var. (%) |

Sector Marketcap |

840257.55 |

357659.89 |

206343.37 |

134.93 |

307.21 |

Total Marketcap |

46847847.76 |

31301254.6 |

28158510.47 |

49.67 |

66.37 |

Sector's share |

1.79 |

1.14 |

0.73 |

0.65 |

1.06 |

Sector No of companies |

22 |

22 |

19 |

0 |

3 |

Total Listed companies |

4747 |

4338 |

4144 |

409 |

603 |

Sector's share |

0.46 |

0.51 |

0.46 |

-0.05 |

0 |

|

28158510.47 |

|

|

|

|

Gainers |

| Company Name |

30/08/2024 |

30/07/2024 |

Var% |

| Zen Technologies |

1694.55 |

1688.20 |

0.38 |

Losers |

| Company Name |

30/08/2024 |

30/07/2024 |

Var% |

| Cochin Shipyard |

1889.90 |

2679.05 |

-29.46 |

| Garden Reach Sh. |

1813.90 |

2438.10 |

-25.60 |

| BEML Ltd |

3797.90 |

4660.90 |

-18.52 |

| Mishra Dhatu Nig |

414.50 |

500.15 |

-17.12 |

| Data Pattern |

2805.55 |

3281.20 |

-14.50 |

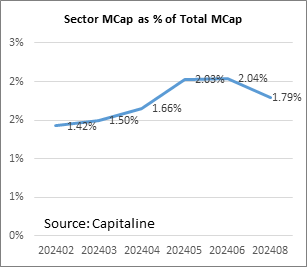

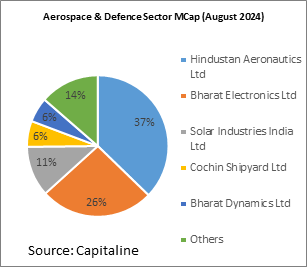

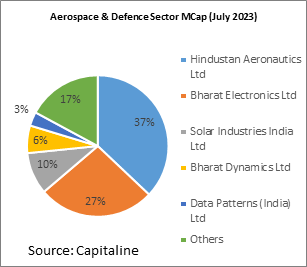

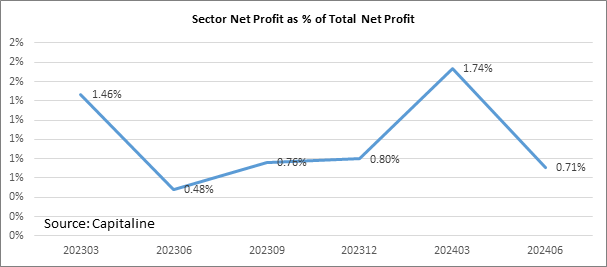

During the month of August 2024, Aerospace & Defence sector’s Marketcap increased 134.93% to Rs 840257.55 crore, compared to 49.67% rise in total listed marketcap to Rs 46847847.76 crore.

Sector’s share of total listed marketcap moved to 1.79% in August 2024 from 1.14% in July 2023 and 0.73% in July 2022.

In terms of price appreciation in the sector, there were 1 gainers and 20 losers in the month of Aug 2024. The gainers accounted for 4.55% of sector companies, losers accounted for 90.91% of sector companies, while 1% remained unchanged.

Zen Technologies (0.38% gain) was the only one gainer.

The 3 losers at the bottom were Cochin Shipyard (-29.46% fall), Garden Reach Sh. (-25.60% fall) and BEML Ltd (-18.52% fall).

During the month Sika Interplant Systems Ltd, BEML Ltd, Taneja Aerospace & Aviation Ltd, Astra Microwave Products Ltd, Rossell India Ltd, Cochin Shipyard Ltd, Hindustan Aeronautics Ltd, Garden Reach Shipbuilders & Engineers Ltd, Mishra Dhatu Nigam Ltd, Bharat Dynamics Ltd, Solar Industries India Ltd, MTAR Technologies Ltd, NIBE Ltd, Apollo Micro Systems Ltd, Paras Defence and Space Technologies Ltd and DCX Systems Ltd announced their results. Of these Sika Interplant Systems Ltd, Taneja Aerospace & Aviation Ltd, Rossell India Ltd, Cochin Shipyard Ltd, Hindustan Aeronautics Ltd, Garden Reach Shipbuilders & Engineers Ltd, Solar Industries India Ltd, NIBE Ltd, Apollo Micro Systems Ltd and Paras Defence and Space Technologies Ltd reported rise in net profit attributable to shareholders. Companies like Bharat Dynamics Ltd, Mishra Dhatu Nigam Ltd, MTAR Technologies Ltd and DCX Systems Ltd reported fall in net profit attributable to shareholders.

Companies like Astra Microwave Products Ltd reported loss to profit

Astra Microwave Products Ltd, Bharat Electronics Ltd, Hindustan Aeronautics Ltd and Rossell India Ltd became ex-dividend.

During the month Sika Interplant Systems Ltd, BEML Ltd, Bharat Electronics Ltd, Taneja Aerospace & Aviation Ltd, Astra Microwave Products Ltd, Rossell India Ltd, Cochin Shipyard Ltd, Hindustan Aeronautics Ltd, Garden Reach Shipbuilders & Engineers Ltd, Mishra Dhatu Nigam Ltd, Bharat Dynamics Ltd, Zen Technologies Ltd, Solar Industries India Ltd, MTAR Technologies Ltd, Data Patterns (India) Ltd, NIBE Ltd, Apollo Micro Systems Ltd, Paras Defence and Space Technologies Ltd, Krishna Defence & Allied Industries Ltd, DCX Systems Ltd, CFF Fluid Control Ltd, Ideaforge Technology Ltd and C2C Advanced Systems Ltd filed their shareholding patterns.

FIIs increased their shareholding in Paras Defence and Space Technologies Ltd from 0.13% to 2.97%, Zen Technologies Ltd from 3.08% to 5.86%, Astra Microwave Products Ltd from 3.17% to 4.67%, Solar Industries India Ltd from 6.10% to 7.57%, Garden Reach Shipbuilders & Engineers Ltd from 3.26% to 3.91%, Data Patterns (India) Ltd from 14.57% to 14.95%, Mishra Dhatu Nigam Ltd from 1.08% to 1.27%, Ideaforge Technology Ltd from 2.75% to 2.93%, Sika Interplant Systems Ltd from 2.64% to 2.77% and Bharat Dynamics Ltd from 2.95% to 3.05%. FIIs reduced their shareholding in CFF Fluid Control Ltd from 0.07% to 0.00%, Bharat Electronics Ltd from 17.56% to 17.43%, Taneja Aerospace & Aviation Ltd from 0.16% to 0.02%, Cochin Shipyard Ltd from 5.23% to 4.94%, NIBE Ltd from 8.30% to 7.89%, Hindustan Aeronautics Ltd from 12.42% to 11.68%, DCX Systems Ltd from 2.30% to 1.28%, Apollo Micro Systems Ltd from 9.75% to 7.42%, MTAR Technologies Ltd from 10.57% to 7.75% and BEML Ltd from 9.91% to 6.76%.

DIIs increased their shareholding in Zen Technologies Ltd from 2.99% to 6.84%, BEML Ltd from 17.59% to 19.08% and Cochin Shipyard Ltd from 2.41% to 2.47%. DIIs reduced their shareholding in DCX Systems Ltd from 7.91% to 7.43%, Hindustan Aeronautics Ltd from 9.10% to 8.36%, Mishra Dhatu Nigam Ltd from 10.94% to 9.23%, Solar Industries India Ltd from 14.17% to 12.41%, MTAR Technologies Ltd from 18.07% to 15.95%, Bharat Electronics Ltd from 20.95% to 18.79%, Bharat Dynamics Ltd from 11.89% to 9.28%, Paras Defence and Space Technologies Ltd from 2.75% to 0.06%, Garden Reach Shipbuilders & Engineers Ltd from 5.36% to 2.55% and Data Patterns (India) Ltd from 11.34% to 8.24%.

Promoters increased their shareholding in NIBE Ltd from 51.43% to 53.08%. Promoters reduced their shareholding in Taneja Aerospace & Aviation Ltd from 52.30% to 52.20%, MTAR Technologies Ltd from 37.26% to 36.42%, DCX Systems Ltd from 62.29% to 59.78%, Zen Technologies Ltd from 55.07% to 51.26% and Krishna Defence & Allied Industries Ltd from 68.33% to 62.27%.

During the month Annual reports of Sika Interplant Systems Ltd, BEML Ltd, Bharat Electronics Ltd, Taneja Aerospace & Aviation Ltd, Tata Advanced Material Ltd, Astra Microwave Products Ltd, Rossell India Ltd, Cochin Shipyard Ltd, Hindustan Aeronautics Ltd, Hindustan Shipyard Ltd, Goa Shipyard Ltd, Garden Reach Shipbuilders & Engineers Ltd, Mishra Dhatu Nigam Ltd, Bharat Dynamics Ltd, Zen Technologies Ltd, Solar Industries India Ltd, MTAR Technologies Ltd, Data Patterns (India) Ltd, Mahindra Aerospace Pvt Ltd, NIBE Ltd, Tata Advanced Systems Ltd, Apollo Micro Systems Ltd, Paras Defence and Space Technologies Ltd, Krishna Defence & Allied Industries Ltd, DCX Systems Ltd, Max Aerospace & Aviation Pvt Ltd, Vem Technologies Pvt Ltd, CFF Fluid Control Ltd, Ideaforge Technology Ltd, P L R Systems Pvt Ltd, Gliders India Ltd, Troop Comforts Ltd, Horizon Aerospace India Pvt Ltd, Magnum Aviation Pvt Ltd, Aviasafe Aviation Services Pvt Ltd, Vertex Aviation Pvt Ltd, Innovative Aviation Pvt Ltd, Epsilon Aerospace Pvt Ltd, Vandana Aircraft Services Pvt Ltd and C2C Advanced Systems Ltd were updated in Capitaline.