Date: 27 Sep 2024

Retail

Sector |

Market Cap |

No of Companies |

Retail |

781482.07 |

72 |

NetWorth |

36838.19 |

TTM Sales |

131948.59 |

TTM Sales Var (%) |

21.37 |

Debt |

39262.87 |

TTM OP |

11344.62 |

TTM NP Var (%) |

25.26 |

Capital Employed |

80320.67 |

TTM OPM (%) |

10.12 |

EV/TM Sales |

5.92 |

Net Block |

43530.49 |

TTM PATM (%) |

3.31 |

EV/TTM EBITDA |

72.03 |

Current Assets |

47215.88 |

Debt / Equity |

1.07 |

P/E |

178.87 |

ROCE (%) |

19.04 |

RONW (%) |

11.86 |

P/B |

21.21 |

The above figures are in Rs. Crores as of 27 Sep 2024

TTM ended June 2024

|

27 Sep 2024 |

31 Aug 2023 |

31 Aug 2022 |

MoM Var. (%) |

YoY Var. (%) |

Sector Marketcap |

781351.38 |

395506.24 |

414155.37 |

97.56 |

88.66 |

Total Marketcap |

48204544.66 |

31119214.75 |

27322306.26 |

54.9 |

76.43 |

Sector's share |

1.62 |

1.27 |

1.52 |

0.35 |

0.1 |

Sector No of companies |

71 |

60 |

46 |

11 |

25 |

Total Listed companies |

4793 |

4372 |

4183 |

421 |

610 |

Sector's share |

1.48 |

1.37 |

1.1 |

0.11 |

0.38 |

Nifty 50 |

26178.95 |

25235.9 |

19638.3 |

3.74 |

33.31 |

Gainers |

| Company Name |

27/09/2024 |

27/08/2024 |

Var% |

| Praxis Home |

26.05 |

14.68 |

77.45 |

| Bizotic Commer. |

74.79 |

49.55 |

50.94 |

| Bhatia Communic. |

31.19 |

22.25 |

40.18 |

| Chandrima Mercan |

38.64 |

29.48 |

31.07 |

| Inertia Steel |

424.00 |

329.45 |

28.70 |

Losers |

| Company Name |

27/09/2024 |

27/08/2024 |

Var% |

| Shanti Guru Inds |

22.00 |

31.40 |

-29.94 |

| White Organic Re |

3.89 |

4.94 |

-21.26 |

| M P Agro Inds. |

10.18 |

12.64 |

-19.46 |

| PNGS Gargi FJ |

791.75 |

976.10 |

-18.89 |

| IFL Enterprises |

1.14 |

1.40 |

-18.57 |

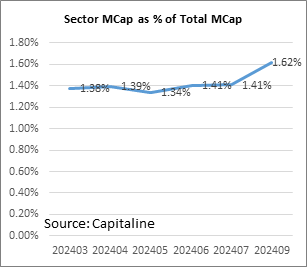

During the month of September 2024, Retail sector’s Marketcap increased 97.56% to Rs 781351.38 crore, compared to 54.9% rise in total listed marketcap to Rs 48204544.66 crore.

Sector’s share of total listed marketcap moved to 1.62% in September 2024 from 1.27% in August 2023 and 1.52% in August 2022.

In terms of price appreciation in the sector, there were 30 gainers and 27 losers in the month of Sep 2024. The gainers accounted for 41.67% of sector companies, losers accounted for 37.50% of sector companies, while 15% remained unchanged.

The top 3 gainers were Praxis Home (77.45% gain), Bizotic Commer. (50.94% gain) and Bhatia Communic. (40.18% gain).

The 3 losers at the bottom were Shanti Guru Inds (-29.94% fall), White Organic Re (-21.26% fall) and M P Agro Inds. (-19.46% fall).

During the month Baazar Style Retail Ltd announced their results.

Baazar Style Retail Ltd reported profit to loss.

During the month IFL Enterprises Ltd became ex-bonus.

Ganesha Ecoverse Ltd company became ex-rights.

Bhatia Communications & Retail (India) Ltd, Cell Point (India) Ltd, Landmark Cars Ltd, Magson Retail and Distribution Ltd, Popular Vehicles & Services Ltd and Sai Silks (Kalamandir) Ltd became ex-dividend.

During the month Trent Ltd, Saptak Chem & Business Ltd, Warren Tea Ltd, Muller & Phipps (India) Ltd, M P Agro Industries Ltd, Future Enterprises Ltd, Salora International Ltd, Asian Petroproducts & Exports Ltd, White Organic Agro Ltd, Rajnish Retail Ltd, Popees Care Ltd, Euro Asia Exports Ltd, Natural Biocon (India) Ltd, Thirdwave Financial Intermediaries Ltd, RCC Cements Ltd, Hit Kit Global Solutions Ltd, Inertia Steel Ltd, Archies Ltd, Allcargo Gati Ltd, Sueryaa Knitwear Ltd, Yamuna Syndicate Ltd, Shoppers Stop Ltd, Vaxfab Enterprises Ltd, Popular Vehicles & Services Ltd, Chandrima Mercantiles Ltd, Radha Madhav Corporation Ltd, V2 Retail Ltd, Shankara Building Products Ltd, Ethos Ltd, V-Mart Retail Ltd, Medplus Health Services Ltd, Sai Silks (Kalamandir) Ltd, Binny Mills Ltd, Credo Brands Marketing Ltd, Aditya Birla Fashion & Retail Ltd, Avenue Supermarts Ltd, Shanti Guru Industries Ltd, Future Lifestyle Fashions Ltd, Encash Entertainment Ltd, Ganesha Ecoverse Ltd, Heads UP Ventures Ltd, Cartrade Tech Ltd, Landmark Cars Ltd, Future Retail Ltd, Naksh Precious Metals Ltd, Brainbees Solutions Ltd, KKV Agro Powers Ltd, Aditya Consumer Marketing Ltd, Aditya Vision Ltd, IFL Enterprises Ltd, Praxis Home Retail Ltd, 7NR Retail Ltd, Hindware Home Innovation Ltd, Brand Concepts Ltd, Bhatia Communications & Retail (India) Ltd, Spencers Retail Ltd, Osia Hyper Retail Ltd, White Organic Retail Ltd, Jetmall Spices and Masala Ltd, Foce India Ltd, Electronics Mart India Ltd, Redtape Ltd, Baazar Style Retail Ltd, Jay Jalaram Technologies Ltd, Mafia Trends Ltd, Logica Infoway Ltd, JHS Svendgaard Retail Ventures Ltd, PNGS Gargi Fashion Jewellery Ltd, Sonalis Consumer Products Ltd, Bizotic Commercial Ltd, Cell Point (India) Ltd, Magson Retail and Distribution Ltd, Patel Retail Ltd, On Door Concepts Ltd, Cellecor Gadgets Ltd, Entero Healthcare Solutions Ltd, Fonebox Retail Ltd, HP Telecom India Ltd and Purple United Sales Ltd filed their shareholding patterns.

FIIs increased their shareholding in Cartrade Tech Ltd from 23.83% to 37.97%, Brainbees Solutions Ltd from 0.00% to 7.12%, Aditya Vision Ltd from 10.23% to 12.12%, Trent Ltd from 26.80% to 27.87%, Landmark Cars Ltd from 8.74% to 9.74%, Avenue Supermarts Ltd from 8.26% to 9.22%, V-Mart Retail Ltd from 15.32% to 15.46%, V2 Retail Ltd from 6.57% to 6.69%, Redtape Ltd from 3.07% to 3.14% and Entero Healthcare Solutions Ltd from 23.30% to 23.32%. FIIs reduced their shareholding in Sai Silks (Kalamandir) Ltd from 3.32% to 2.86%, Credo Brands Marketing Ltd from 2.72% to 1.89%, Aditya Birla Fashion & Retail Ltd from 19.64% to 18.76%, Popular Vehicles & Services Ltd from 7.01% to 6.00%, Spencers Retail Ltd from 9.38% to 8.32%, Shankara Building Products Ltd from 11.77% to 10.34%, Hindware Home Innovation Ltd from 7.49% to 6.05%, Fonebox Retail Ltd from 10.31% to 8.79%, Cellecor Gadgets Ltd from 4.41% to 0.77% and Osia Hyper Retail Ltd from 12.36% to 0.04%.

DIIs increased their shareholding in Cartrade Tech Ltd from 4.22% to 11.47%, Brainbees Solutions Ltd from 0.00% to 5.35%, Ethos Ltd from 11.23% to 12.26%, Redtape Ltd from 7.79% to 8.81%, Aditya Birla Fashion & Retail Ltd from 14.33% to 15.32%, Popular Vehicles & Services Ltd from 9.73% to 10.33%, Aditya Vision Ltd from 7.56% to 7.83% and Electronics Mart India Ltd from 16.41% to 16.61%. DIIs reduced their shareholding in Shankara Building Products Ltd from 4.78% to 4.42%, Medplus Health Services Ltd from 13.79% to 13.37%, Hindware Home Innovation Ltd from 1.90% to 1.47%, Avenue Supermarts Ltd from 8.19% to 7.63%, Future Retail Ltd from 1.63% to 1.02%, Trent Ltd from 13.18% to 12.39%, Credo Brands Marketing Ltd from 7.81% to 6.84%, Cellecor Gadgets Ltd from 1.02% to 0.00%, Sai Silks (Kalamandir) Ltd from 17.30% to 16.21% and V-Mart Retail Ltd from 33.43% to 32.23%.

Promoters increased their shareholding in IFL Enterprises Ltd from 2.26% to 2.76%, Shoppers Stop Ltd from 65.54% to 65.58%, Redtape Ltd from 71.76% to 71.79% and V2 Retail Ltd from 54.28% to 54.30%. Promoters reduced their shareholding in Future Lifestyle Fashions Ltd from 20.39% to 20.30%, Osia Hyper Retail Ltd from 48.34% to 48.16%, Heads UP Ventures Ltd from 13.79% to 13.56%, Ethos Ltd from 55.72% to 54.71%, Jetmall Spices and Masala Ltd from 21.31% to 20.11%, PNGS Gargi Fashion Jewellery Ltd from 72.08% to 70.85%, Hit Kit Global Solutions Ltd from 9.81% to 7.82%, Aditya Birla Fashion & Retail Ltd from 51.97% to 49.26%, Future Retail Ltd from 18.24% to 14.31% and Natural Biocon (India) Ltd from 21.22% to 9.36%.

During the month Annual reports of Trent Ltd, Saptak Chem & Business Ltd, Warren Tea Ltd, Muller & Phipps (India) Ltd, M P Agro Industries Ltd, Devrup Trading Ltd, Bombay Swadeshi Stores Ltd, Salora International Ltd, Asian Petroproducts & Exports Ltd, White Organic Agro Ltd, Rajnish Retail Ltd, Popees Care Ltd, Euro Asia Exports Ltd, Natural Biocon (India) Ltd, Thirdwave Financial Intermediaries Ltd, RCC Cements Ltd, Hit Kit Global Solutions Ltd, Inertia Steel Ltd, Archies Ltd, Allcargo Gati Ltd, Sueryaa Knitwear Ltd, Yamuna Syndicate Ltd, Schuler India Pvt Ltd, Shoppers Stop Ltd, DLF Universal Ltd, Nidhan Commercial Company Ltd, Vaxfab Enterprises Ltd, Popular Vehicles & Services Ltd, Chandrima Mercantiles Ltd, Radha Madhav Corporation Ltd, V2 Retail Ltd, Hindware Home Retail Pvt Ltd, Shankara Building Products Ltd, Rathna Fan House Pvt Ltd, Rathna Cools Pvt Ltd, Ethos Ltd, Higginbothams Pvt Ltd, Arvind Lifestyle Brands Ltd, Bombay Store Retail Company Ltd, V-Mart Retail Ltd, More Retail Pvt Ltd, Medplus Health Services Ltd, Sai Silks (Kalamandir) Ltd, Flemingo Dutyfree Shop Pvt Ltd, Heritage Nutrivet Ltd, Binny Mills Ltd, Natures Basket Ltd, Idea International Pvt Ltd, Credo Brands Marketing Ltd, Au Bon Pain Cafe India Ltd, Aditya Birla Fashion & Retail Ltd, Avenue Supermarts Ltd, Reliance Petro Marketing Ltd, Reliance Retail Ltd, Mahindra Retail Ltd(Merged), Infiniti Retail Ltd, Shanti Guru Industries Ltd, Inditex Trent Retail India Pvt Ltd, Future Lifestyle Fashions Ltd, Trent Hypermarket Ltd, BF Elbit Advanced Systems Pvt Ltd, Arshiya Lifestyle Ltd, Encash Entertainment Ltd, Reliance Inceptum Pvt Ltd (Merged), Ganesha Ecoverse Ltd, Heads UP Ventures Ltd, Cartrade Tech Ltd, Landmark Cars Ltd, Naksh Precious Metals Ltd, Brainbees Solutions Ltd, Energy Efficiency Services Ltd, KKV Agro Powers Ltd, Aditya Consumer Marketing Ltd, Intellect Commerce Ltd, Aditya Vision Ltd, Ishanya Brand Services Ltd, IFL Enterprises Ltd, Delhi Duty Free Services Pvt Ltd, Dealskart Online Services Pvt Ltd, GKB Lens Pvt Ltd, Praxis Home Retail Ltd, K P Cars Pvt Ltd, 7NR Retail Ltd, Hindware Home Innovation Ltd, Intermesh Shopping Network Pvt Ltd, Brand Concepts Ltd, Wellness Forever Medicare Ltd, Bhatia Communications & Retail (India) Ltd, CL Media Pvt Ltd, Samvardhana Motherson Auto System Pvt Ltd, Minox Metal Pvt Ltd, Cellucom Retail India Pvt Ltd, Spencers Retail Ltd, Osia Hyper Retail Ltd, White Organic Retail Ltd, Jewel Alliance Network Pvt Ltd, Mandya Organic Foods Pvt Ltd, Jetmall Spices and Masala Ltd, Reliance Retail & Fashion Lifestyle Ltd, Sahyadri Agro Retails Ltd, Foce India Ltd, Electronics Mart India Ltd, Redtape Ltd, H & M Hennes & Mauritz Retail Pvt Ltd, Realme Mobile Telecommunications India Pvt Ltd, Baazar Style Retail Ltd, Jay Jalaram Technologies Ltd, Mafia Trends Ltd, RMKV Silk Pvt Ltd, Tower Overseas Ltd, Flemingo Duty Free Shop Mumbai Pvt Ltd, Louis Vuitton India Retail Pvt Ltd, Cooke & Kelvey Pvt Ltd, Logica Infoway Ltd, Suumaya Retail Ltd, JHS Svendgaard Retail Ventures Ltd, PNGS Gargi Fashion Jewellery Ltd, Sonalis Consumer Products Ltd, Kolte-Patil Properties Pvt Ltd, Kapsons Retail Pvt Ltd, Owndays India Pvt Ltd, Bizotic Commercial Ltd, Cell Point (India) Ltd, Magson Retail and Distribution Ltd, Pep Technologies Pvt Ltd, Decent Industries Pvt Ltd, Patel Retail Ltd, Arvind Premium Retail Ltd, Amazon Retail India Pvt Ltd, On Door Concepts Ltd, Cellecor Gadgets Ltd, Entero Healthcare Solutions Ltd, Fonebox Retail Ltd, Pasadena Retail Pvt Ltd, Island East Watch & Fashions Pvt Ltd, Swiss Group India Pvt Ltd, Inspirebrio Ventures Pvt Ltd, Limestone Fashion Pvt Ltd, Ramesh Watch Company Pvt Ltd, Mayasheel Retail India Ltd, ABS Seating Pvt Ltd, Sana Lifestyles Ltd, Shrasta Decor Pvt Ltd, Stanley Retail Ltd, Staras Seating Pvt Ltd, Stanley OEM Sofas Ltd, HP Telecom India Ltd, EMIL Traders Pvt Ltd, Purple United Sales Ltd and Reward360 Global Services Pvt Ltd were updated in Capitaline.