Date: 27 Sep 2024

Tobacco Products

Sector |

Market Cap |

No of Companies |

Tobacco Products |

697182.61 |

7 |

NetWorth |

79201.50 |

TTM Sales |

76326.87 |

TTM Sales Var (%) |

4.71 |

Debt |

772.89 |

TTM OP |

27185.41 |

TTM NP Var (%) |

0.19 |

Capital Employed |

83593.54 |

TTM OPM (%) |

39.44 |

EV/TM Sales |

9.13 |

Net Block |

31317.05 |

TTM PATM (%) |

27.92 |

EV/TTM EBITDA |

25.41 |

Current Assets |

43242.44 |

Debt / Equity |

0.01 |

P/E |

32.72 |

ROCE (%) |

89.65 |

RONW (%) |

26.91 |

P/B |

8.80 |

The above figures are in Rs. Crores as of 27 Sep 2024

TTM ended June 2024

|

27 Sep 2024 |

31 Aug 2023 |

31 Aug 2022 |

MoM Var. (%) |

YoY Var. (%) |

Sector Marketcap |

697182.61 |

565386.77 |

408017.67 |

23.31 |

70.87 |

Total Marketcap |

48204544.66 |

31119214.75 |

27322306.26 |

54.9 |

76.43 |

Sector's share |

1.45 |

1.82 |

1.49 |

-0.37 |

-0.04 |

Sector No of companies |

7 |

6 |

5 |

1 |

2 |

Total Listed companies |

4793 |

4372 |

4183 |

421 |

610 |

Sector's share |

0.15 |

0.14 |

0.12 |

0.01 |

0.03 |

Nifty 50 |

26178.95 |

25235.9 |

19638.3 |

3.74 |

33.31 |

Gainers |

| Company Name |

27/09/2024 |

27/08/2024 |

Var% |

| Elitecon Inter. |

29.95 |

11.57 |

158.86 |

| Godfrey Phillips |

6995.35 |

5731.95 |

22.04 |

| ITC |

522.75 |

500.60 |

4.42 |

| Sinnar Bidi Udy. |

743.65 |

721.00 |

3.14 |

Losers |

| Company Name |

27/09/2024 |

27/08/2024 |

Var% |

| VST Industries |

381.20 |

431.25 |

-11.61 |

| NTC Industries |

209.00 |

234.15 |

-10.74 |

| Indian Wood Prod |

34.11 |

37.53 |

-9.11 |

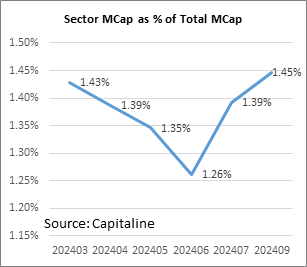

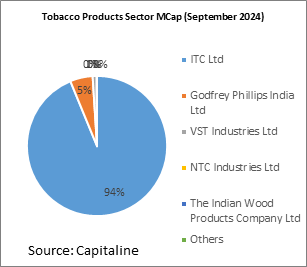

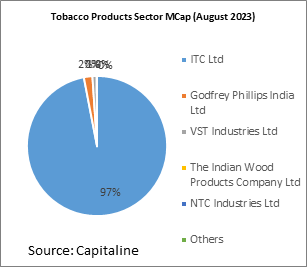

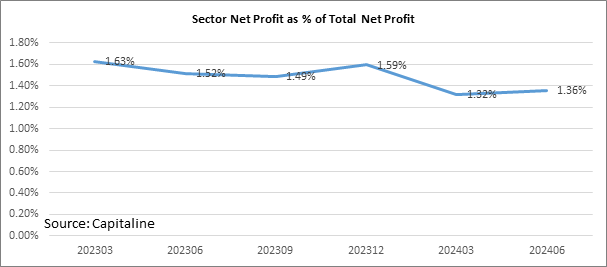

During the month of September 2024, Tobacco Products sector’s Marketcap increased 23.31% to Rs 697182.61 crore, compared to 54.9% rise in total listed marketcap to Rs 48204544.66 crore.

Sector’s share of total listed marketcap moved to 1.45% in September 2024 from 1.82% in August 2023 and 1.49% in August 2022.

In terms of price appreciation in the sector, there were 4 gainers and 3 losers in the month of Sep 2024. The gainers accounted for 57.14% of sector companies, losers accounted for 42.86% of sector companies.

The top 3 gainers were Elitecon Inter. (158.86% gain), Godfrey Phillips (22.04% gain) and ITC (4.42% gain).

The 3 losers at the bottom were VST Industries (-11.61% fall), NTC Industries (-10.74% fall) and Indian Wood Prod (-9.11% fall).

During the month VST Industries Ltd became ex-bonus.

The Indian Wood Products Company Ltd became ex-dividend.

During the month ITC Ltd, VST Industries Ltd, Godfrey Phillips India Ltd, Sinnar Bidi Udyog Ltd, NTC Industries Ltd, The Indian Wood Products Company Ltd and Elitecon International Ltd filed their shareholding patterns.

FIIs increased their shareholding in VST Industries Ltd from 1.83% to 1.95% and Godfrey Phillips India Ltd from 10.77% to 10.83%. FIIs reduced their shareholding in ITC Ltd from 15.43% to 14.96%.

DIIs increased their shareholding in Godfrey Phillips India Ltd from 1.49% to 1.86% and ITC Ltd from 31.77% to 32.06%. DIIs reduced their shareholding in NTC Industries Ltd from 0.02% to 0.00% and VST Industries Ltd from 12.64% to 9.39%.

During the month Annual reports of ITC Ltd, VST Industries Ltd, Godfrey Phillips India Ltd, Sinnar Bidi Udyog Ltd, NTC Industries Ltd, Chemtex Engineering of India Pvt Ltd, The Indian Wood Products Company Ltd, International Tobacco Company Ltd, Prabhudas Kishordas Tobacco Products Ltd, Dharampal Satyapal Ltd, Dharampal Premchand Ltd, Cigfil Ltd, Pan Parag India Ltd, Bommidala Enterprises Pvt Ltd, Premier Tobacco Packers Pvt Ltd, Miraj Products Pvt Ltd, Desai Brothers Ltd, Pataka Industries Pvt Ltd, Elitecon International Ltd, Dhariwal Industries Pvt Ltd, Urmin Products Pvt Ltd, Southern India Bidi Works Pvt Ltd, ATC Ltd, Bharath Beedi Works Pvt Ltd, B S Patel Bidi Pvt Ltd, Thakur Savadekar & Co. Pvt Ltd, Sunderlal Moolchand Jain Tobacconist Pvt Ltd, Reliable Cigarette & Tobacco Inds. Pvt Ltd, Vishnu Aromatics Ltd, Shree G M Thaokar (Tobacco) Pvt Ltd, Patel Pan Products Ltd, Agrimmcor Creations Ltd, Kiara Packaging Inds. Pvt Ltd, Baba Global Ltd, Bit Corp Pvt Ltd and Shiv Biri Manufacturing Co Pvt Ltd were updated in Capitaline.