|

Asia's caustic soda prices are expected to remain robust in the near term, supported by restricted supply and persistently low by-product chlorine prices. Domestic caustic prices have remained firm as the capacity utilization in the chlor-alkali industry capacity was affected due to the low chlorine offtake and also due to high international prices. On the other side chlorine prices had declined to abnormal levels. Electro Chemical Unit (ECU) realizations of chlor-alkali players have grown at a healthy pace in the last one-year upto March 2012, due to higher caustic prices. However, the ECU realizations have dipped for some players during the quarter ended March 2012, when compared with the previous quarter. Though the caustic soda prices have increased in the last one-year, it has been offset by higher cost.

The factors that had lead to the increase in price over the last one year have been the increase in energy and salt cost for the manufactures. On the other hand, anti-dumping duty imposed on caustic soda imports led to prices strengthening in the short term. Moreover, the sharp rupee depreciation, lead to rise in the landed cost of import, enabled companies to raise domestic prices.

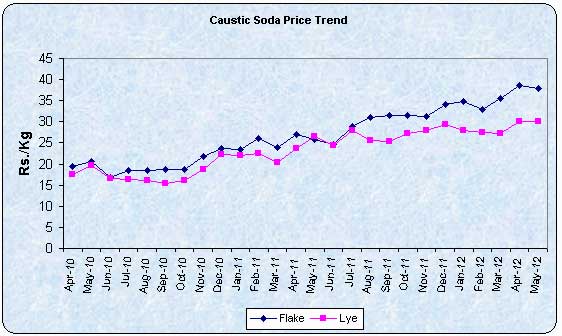

Sequentially, retail average caustic soda flake prices remains elevated on y-o-y basis for 18 months in succession since December 2010 through May 2012. Sequentially prices have been gyrating, with intermediate ups and downs.

Caustic soda lye prices followed the same pattern, but the pace of rise was modest on y-o-y basis. The pace of growth in caustic soda lye prices eased from 33.6% rise in March 2012 to 26.3% increase in April 2012, which gave way for further moderation to 15.7% improvement on y-o-y basis in May 2012. On the other hand, the caustic soda flake prices were 47.9% higher in March 2012, 43.1% higher in April 2012 and 49.2% higher in May 2012.

Caustic soda lye prices are invariably lower than flake prices. The former can be sold to users nearby in liquid form. But transporting them in that form will involve higher freight costs. So, players convert the same into flakes for selling to far away places. We find that the discount of caustic soda lye prices over flake prices have been generally widening from –3% (means caustic soda lye prices were higher than prill prices) in May 2011 to 23% discount in March 2012, which eased to 20% by May 2012.

While retail prices of caustic soda (lye) remained at Rs 30 per kg in May 2012, after a sharp rise in April 2012. On Year-on-Year (Y-o-Y) basis the retail prices continue to be at higher level. Retail prices of caustic soda (flake) increased by 48% per kg and caustic soda (lye) increased by 13% per kg in May 2012. The price growth is higher for flake and lower for lye when we look at the price growth in the similar period of the previous year.

For the fiscal ending March 2012, flake prices were up by 47% per kg, which is higher than the decline of 4% per kg in the previous fiscal. Lye prices are up by 43% per kg for the fiscal ending March 2012, which is higher than the increase of 2% per kg in the previous year.

Global chlorine production has improved, that had seen cut back in production towards the end of 2011, due to lower chlorine demand. Chlorine and caustic soda are co-products that are evenly produced by the chlor-alkali industry. Since chlorine cannot be stored, chlor-alkali plants are operated in line with demand for chlorine.

Europe's April Chlorine Output Fell by 2.7%, caustic soda stocks improve sequentially

Chlorine Production of Euro Chlor members that increased by 12.9% in March 2012 on sequential basis fell by 2.7% (by 22819 tonnes) to 8.34 lakh tonnes in April 2012. With 27803 tonnes, the April average daily production was 0.6% higher than in the previous month (March 2012: 27642 tonnes), and 0.2% higher than in April 2011 (27737 tonnes).

The capacity utilization that improved to 80.2% in March 2012, improved further to 80.7% in April 2012. Like 2011 the April caustic soda stocks (at 278994 tonnes) showed an increase of 11.6% over the previous month (March 2012: 250098 tonnes), and were 18319 tonnes above the level of April 2011 (260675 tonnes).

US April chlor-alkali operating rate stays flat at 86%

US chlor-alkali production was 86% of capacity in April 2012, the same as in March 2012, according to US trade group.

Background

The Chlor-Alkali Industry produces Caustic Soda, Chlorine, Hydrogen and Hydrochloric Acid. Hydrogen and Chlorine, the bye-products of Caustic Soda manufacture, are used to produce Hydrochloric Acid. These products are being used in various industrial sectors, either as raw materials or intermediate or auxiliary chemicals. Among them Caustic Soda and Chlorine are the most important inorganic chemicals used by almost all industries for one or the other purpose. Caustic soda is produced in a liquid form, which is called ‘lye', and is converted into flakes or solids through an evaporation process. Though caustic soda is sold in both liquid and solid forms, lye accounts for a major portion of sales, as most companies prefer the aqueous solution.

The domestic installed Caustic Soda capacity is 3.25 million TPA in 2010-11. According to the Alkali Manufacturers' Association of India (AMAI), the Indian caustic soda industry constitutes 4% of the global industry. Globally the installed capacity of caustic soda is 85 Million Metric Tonne (MMT). Around 55% of the global chlor alkali capacity is now in Asia. Domestic capacity utilization was 80% in FY'11 compared to 74% globally.

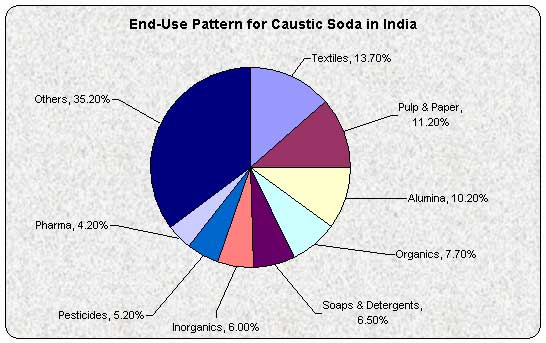

Caustic Soda is primarily used in industry segment such as Aluminium, Pulp & Paper, Textile, Soap, Edible Oil Refineries, Dyes & Chemicals, Drugs & Drug Intermediates, Thermal Power Plant etc. Since caustic soda being a very basic chemical, it is used in many manufacturing activities, there has been never a demand problem for caustic soda in India. The demand of Chlor-Alkali products has a direct co-relation to the overall growth of the economy of the country.

Chlorine is used in industry segment such as PVC, Pulp & Paper, Pesticides, Chloromethanes, Refrigerant Gases, Water Purification, Stable Bleaching Powder, Aluminium Chloride, Chlorinated Solvents etc. Hydrochloric Acid is used in industry segment such as Steel Pickling, Water Treatment, Effluent Treatment in Chemical Process Industries, Thermal Power Plants etc. Hydrogen is used in industry segment such as Hydrogenated Vegetable Oils, Sorbitol, Stearic Acid, Pesticides, Filament Lamps, Picture Tubes, Steel units, Power Plants (in Turbo cooling) etc.

Aditya Birla Group is the market leader in Indian chlor alkali sector, though company wise, Gujarat Alkalies & Chemicals remains the market leader. GACL has 429000 Metric tonne (MT) of Caustic Soda and has about 18% share in the domestic Chlor-Alkali market in India. Moreover caustic soda business segment alone constitutes around 60% of its sales and profit. The other major producers are Grasim Industries, Aditya Birla Chemicals, Aditya Birla Nuvo, DCM Shriram Consolidated, Reliance Industries, Sree Rayalseema Alkalies & Allied Industries, Chemplast Sanmar, Meghmani Finechem etc.

| Major Players in the Indian caustic soda sector |

|

As On |

Capacity (Units in MT) |

| Grasim |

31-Mar-11 |

258000 |

| Aditya Birla Chemicals* (AB Chemicals) |

16-Apr-11 |

220000 |

| Aditya Birla Nuvo (AB Nuvo) |

31-Mar-11 |

91250 |

| Aditya Birla Group |

|

569250 |

| Gujarat Alkalies & Chemicals |

31-Mar-11 |

429000 |

| DCM Shriram Consolidated (DSCL) |

31-Mar-11 |

274670 |

| Reliance Industries |

31-Mar-11 |

168150 |

| Sree Rayalseema Alkalies |

31-Mar-11 |

123950 |

| Gujarat Flurochemicals |

31-Mar-11 |

117000 |

| Chemplast Sanmar |

31-Mar-11 |

113850 |

| Meghmani Finechem |

31-Mar-11 |

110000 |

| Punjab Alkalies |

31-Mar-10 |

99000 |

| Lords Chloro |

31-Mar-11 |

84150 |

| Mawana Sugars |

31-Mar-11 |

82500 |

| Travancore-Cochin Chemicals |

31-Mar-10 |

57750 |

| Tamil Nadu Petro Products |

31-Mar-11 |

56100 |

| Jayshree Chem. |

31-Mar-11 |

53200 |

| Chemfab Alkalies |

31-Mar-11 |

42000 |

| * includes 1.15 lakh tonne facility of Kanoria Chemicals acquired in May 2011 |

Of the total installed capacity of fifteen large players in the Indian caustic soda sector, Aditya Birla Group accounts for 26% of the total installed capacity. Aditya Birla group has chlor alkali capacity in Grasim Industries, Aditya Birla Nuvo and Aditya Birla Chemicals. Aditya Birla Group's has a caustic soda capacity of over 5.5 lakh tonne. This includes 1.15-lakh tonne caustic soda (and 0.93 lakh tonne chlorine facility) capacity acquired from Kanoria Chemicals for Rs 830 crore by Aditya Birla Chemicals in May 2011. As a result of this acquisition, Aditya Birla Chemicals caustic soda capacity increased to 2.2 lakh tonne. Since caustic soda is an important input in production of alumina (an intermediate product used in production of aluminium) sector, this would be beneficial for Aditya Birla Group company Hindalco's aluminium business.

Operating Rates of Caustic Soda Players

Operating rates in the industry have been poor at about 75% in recent years, which implies that there is sufficient capacity to meet the growth in demand for the next few years. Despite this, some additional capacity is being created, largely to meet captive demand either for chlorine or caustic soda. In the last five years, the lowest capacity utilization has been during 2009-10, with about 74% due to heavy caustic soda imports from US & other Countries, while the highest capacity utilization has been during 2006-07, with about 87%. During the last five years, average capacity utilization has declined from 87% to 76% due to increased imports at cheaper rates and some times due to low demand of chlorine.

Inter-regional trade in caustic soda is limited – as transportation by roads is uneconomical for lye, although some material flows from south to the east have been seen. This has been aided with the recent availability of railway wagons for transportation.

Of the total capacity of 3.25 million metric tonne per annum (mmtpa) in India, 54% of the capacity is being located in the west parts of the country, 21% on south, 13% in North and 12% in East.

| Operating Rates (%) of Select Caustic Players |

|

FY2005 |

FY2006 |

FY2007 |

FY2008 |

FY2009 |

FY2010 |

FY2011 |

| Grasim |

84.89 |

86.74 |

52.98 |

73.08 |

80.32 |

89.07 |

93.81 |

| Aditya Birla Chemicals |

105.97 |

60.39 |

93.40 |

85.56 |

79.58 |

95.23 |

93.66 |

| Aditya Birla Nuvo |

108.29 |

97.69 |

82.39 |

90.68 |

86.11 |

96.71 |

96.36 |

| DCM Shriram Consolidated |

84.38 |

84.73 |

98.02 |

94.83 |

67.65 |

66.16 |

76.37 |

| Jayashree Chemicals |

90.94 |

106.53 |

106.53 |

108.32 |

108.50 |

97.75 |

39.30 |

| Kanoria Chemicals |

90.70 |

92.41 |

85.44 |

61.34 |

73.60 |

72.34 |

66.51 |

| Chemfab Alkalies |

93.84 |

96.21 |

102.25 |

90.63 |

69.59 |

78.50 |

70.08 |

| Sree Rayalseema Alkalies |

77.69 |

92.08 |

99.76 |

73.15 |

82.44 |

74.49 |

83.20 |

| Chemplast Sanmar |

99.73 |

82.46 |

88.72 |

89.76 |

87.11 |

87.22 |

93.20 |

| Punjab Alkalies |

81.33 |

96.28 |

98.59 |

96.11 |

85.41 |

74.10 |

78.96 |

| Tamil Nadu Petro Products |

106.11 |

105.48 |

104.88 |

99.54 |

94.27 |

91.43 |

86.02 |

| Source: Capitaline Database |

| Status of Indian Caustic Soda Industry |

| Region |

Total Capacity MMTPA |

Capacity Distribution (%) |

No. of Plants |

| East |

0.4 |

12 |

8 |

| West |

1.76 |

54 |

16 |

| North |

0.4 |

13 |

4 |

| South |

0.68 |

21 |

9 |

Total Capacity as on 1 April 2011

Source: AMAI |

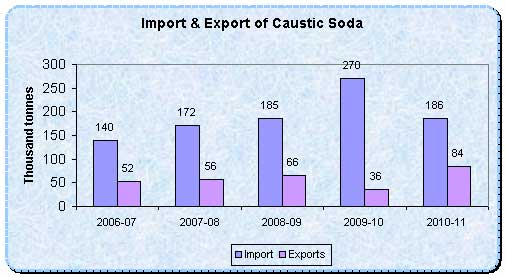

Import & Export of Caustic Soda

Imports have increased from 0.14 million tonnes in 2006-07 to 0.186 million tonnes in 2010-11. About 0.27 million tonnes of caustic soda was imported in 2009-10. Exports increased from 52,000 tons to 84,000 tonnes during the same period.

Caustic Soda Sales Volumes & Sales Value of Select Players

We took a sample of frontline listed players in the caustic soda sector comprising of (1) Gujarat Alkalies & Chemicals (2) Grasim Industries (3) Aditya Birla Chemicals (4) DCM Shriram Consolidated (5) Aditya Birla Nuvo (6) Kanoria Chemicals (7) Chemfab Alkalies (8) Sree Rayalseema Alkalies (9) Punjab Alkalies & Chemicals (10) Chemplast Sanmar.

The Aggregate caustic soda sales volume of the above dozen caustic soda players increased by 12% in FY 2006-07, but since then the pace of growth has been tapering down to 11% in FY 2007-08, and decelerated sharply to 3%, 5% and 4% respectively during FY 2008-09, FY 2009-10 and FY 2010-11 respectively.

Caustic soda value wise (Rs crore), the sector recorded impressive 28% growth in FY 2008-09, but witnessed relatively steeper 19% fall in FY 2009-10 and fell by 5% in FY 2010-11.

Due to the global melt down in year 2008 and dumping of material at low price, the caustic soda sector in India was affected largely in terms of production and price realization. The average caustic soda realization (Rs per tonne) surged up 27% in FY 2005-06, but the growth moderated to mere 7% in FY 2006-07. Finally, the sector settled down for 4% fall in realizations in FY 2007-08. But with recovery in global markets, and relatively better demand, the sector recorded impressive 24% rise in average realizations in FY 2008-09, but gave up most of the gains with 23% fall in realization in FY 2009-10 and fell by 8% in FY 2010-11.

Grasim Industries records 30% spike in ECU realization

Caustic soda volumes of Grasim Industries, at 72839 tonne improved 7% yoy. Sequentially, ECU realization of Grasim has increased for the fifth consecutive quarter.

Caustic soda segment's revenues grew 41% yoy to Rs 219.7 crore driven by 30% jump in ECU realization to Rs 24612 per tonne. However caustic soda segment's EBIDTA grew just 10% yoy (down 32% qoq) as higher salt & energy costs impacted margins which declined by 420 bps yoy and 790 bps qoq to 14.7%. The margins also got impacted by one time remembraning expenses incurred in Q4.

Caustic capacity expansion of 182500 TPA at Vilayat is progressing as per schedule and is expected to commission in Q4 FY13. The expansion when completed will take the total caustic soda capacity of Grasim from 2,58,000 TPA to 4,40,500 TPA.

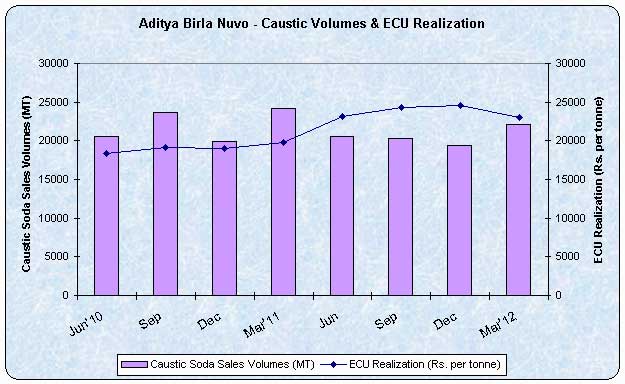

Aditya Birla Nuvo recorded 16% improvement in ECU realization

ECU realization of Aditya Birla Nuvo rose up 16% to Rs 22993 per tonne yoy but fell by 6% qoq. During FY 2012, ECU realization rose by 24% to Rs 23700 per tonne due to surge in caustic soda prices due to demand – supply mismatch. Volumes fell by 8.8% to 22063 tonne on yoy basis but increased by 14% on qoq basis.

Revenues from caustic soda business improved by 18% to Rs 213 crore in FY 2012 from Rs 181 crore in FY 2011. Aditya Birla Nuvo has undertaken expansion of caustic soda capacity by 125 TPD to reach 375 TPD. The expansion project is expected completion in FY14.

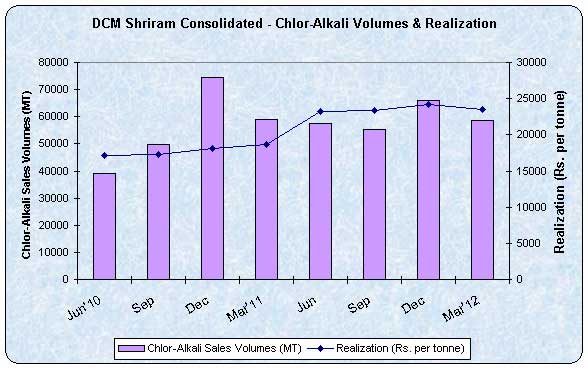

Healthy growth in chloro vinyl business of DCM Shriram Consolidated

The chloro vinyl business of DCM Shriram Consolidated (DSCL) recorded healthy 12.7% rise in segment revenues to Rs 261.4 crore in the quarter ended March 2012. This segment's margins doubled to 21% in the quarter ended March 2012 from 9.8% in the corresponding previous quarter. In view of better sales and spike in margins, the PBIT of this segment surged by 141.9% to Rs 54.8 crore.

DSCL recorded 0.2% fall in sales volumes to 58743 tonne in the quarter ended March 2012 but it improved by 12.2% to 234435 tonne during FY12, in its chlor alkali segment. DSCL indicated that the Electro Chemical Unit (ECU) realizations grew at a healthy pace. DSCL's ECU realizations improved by 26.2% to Rs 23544 per tonne in the quarter ended March 2012. The realizations surged by 31.3% to Rs 23542 per tonne during FY12. The company record 29.5% rise in revenues to Rs 152 crore and 169.7% spike in PBIT to Rs 41.5 crore in the chlor alkali segment during the quarter ended March 2012. For FY12, the company record 48% rise in revenues to Rs 585.1 crore, and 170.6% spike in PBIT to Rs 151 crore in the chlor alkali segment.

Operations at both, Kota and Bharuch continued to deliver optimal chlor-alkali production which benefited from realizations improvement for the company. There was a significant increase in realizations in both the locations. Through the earnings remained strong, the business continues to face input cost pressure due to increase in prices of key input costs (coal & salt) which moderated the earnings.

DCW net profit rose 21.84% in the quarter ended March 2012

Net profit of DCW rose 21.84% to Rs 3.85 crore in the quarter ended March 2012 as against Rs 3.16 crore during the quarter ended March 2011. Sales rose 9.18% to Rs 320.92 crore in the quarter ended March 2012 as against Rs 293.94 crore during the quarter ended March 2011.

For the full year, net profit rose 6.68% to Rs 30.84 crore in the year ended March 2012 as against Rs 28.91 crore during the previous year ended March 2011. Sales rose 11.63% to Rs 1180.61 crore in the year ended March 2012 as against Rs 1057.65 crore during the previous year ended March 2011.

DCW's sales from Caustic Soda business improved by 21.39% to Rs 153.41 crore during the quarter ended March 2012 as against Rs 126.38 crore during the quarter ended March 2011. Profit before Interest and Tax (PBIT) rose to Rs 31.77 crore during the quarter ended March 2012 from Rs 4.38 crore during the quarter ended March 2011. For the unaudited full year, sales from Caustic Soda business rose 24.30% to Rs 521.98 crore in the year ended March 2012 as against Rs 419.93 crore during the previous year ended March 2011. PBIT from this segment increased to Rs 94.94 crore in the year ended March 2012 as against Rs 24.82 crore during the previous year ended March 2011.

Aditya Birla Chemicals net profit declines 85.55%

Net profit of Aditya Birla Chemicals declined 85.5% to Rs 3.06 crore in the quarter ended March 2012 as against Rs 21.17 crore during the previous quarter ended March 2011. Sales rose 175.7% to Rs 166.34 crore in the quarter ended March 2012 as against Rs 60.34 crore during the previous quarter ended March 2011.

For the audited full year, net profit declined 93.2% to Rs 4.29 crore in the year ended March 2012 as against Rs 62.71 crore during the previous year ended March 2011. Sales rose 157.8% to Rs 609.08 crore in the year ended March 2012 as against Rs 236.25 crore during the previous year ended March 2011.

Power Cost in India is the Highest Amongst Other Countries

The major input in Chlor-Alkali Industry is Power. In case of Caustic Soda, power constitutes more than 60% of the cost of production. Today, the cost of power in India is quite high. In some States, it is ranging from Rs.5.35 to 6.00 per unit. With such high power cost, the industry cannot compete in the International market. If we compare the power cost internationally India is at a disadvantage. When we compare the power cost with other major countries, USA has a lower power cost of US$ 0.068 / KWH, China has a power cost of US $ 078 / KWH, while India has a power cost compared to other countries. In USA, Shale Gas is emerging as cheap source of energy, whereas in India coal is resulting in increased power costs.

Asian scenario

Northeast Asia is a major exporter of caustic soda and has an estimated capacity of close to 39m dmt, which is almost half of the global capacity. China is the biggest caustic soda producer globally, with a capacity that reached 32m dmt in 2011.

The average operating rate of caustic soda plants in China is estimated to be at around 60-70% at the moment. Chinese chlor-alkali producers are expected to maintain their productions at lower levels as there is no anticipated uptick in the chlorine-derivatives segment.

Demand from chlorine's downstream markets are in a bearish state. As a result, chlor-alkali producers raised their caustic soda offers to fetch higher prices to protect their margins.

In addition to the reduced supply from China, caustic soda producers in Taiwan and Korea are unlikely to participate actively in the spot market in the near future as they are focusing on supplies to their respective domestic markets as well as contractual commitments. Thus, China is left as the main provider of spot parcels from northeast Asia for the time being.

In Japan, producers are currently not in a position to offer spot materials amid ongoing and upcoming plant turnarounds at several chlor-alkali facilities that will last until mid-June.

Outlook

The global caustic soda market is facing pressure from the weak conditions in the downstream polyvinyl chloride (PVC) market as chlor-alkali producers strive to maintain their margins amid the prevailing low co-product chlorine prices.

The weak demand in the PVC market is limiting caustic soda production as integrated chlor-alkali producers struggle to balance their production of caustic soda against chlorine output.

In the domestic scene, for caustic soda manufactures, cost of production is expected to remain higher due to higher fuel cost. The domestic caustic soda demand is expected to remain healthy and the prices are expected to move upwards. The sharp depreciation of Indian rupee will make the imports costlier, helping firmness in domestic prices, besides helping better offtake from domestic players.

Asia's caustic soda prices are expected to remain robust in the near term, supported by restricted supply and persistently low by-product chlorine prices. Several chlor-alkali producers in China are operating their plants at reduced rates to balance chlorine production in the midst of low chlorine prices and the dismal condition in the chlorine-derivatives market, leading to tight availability of caustic soda cargoes for the spot market. So, ECU realizations globally are expected to remain firm in the near term. India will have the added advantage of depreciation of rupee.

|