|

The Indian cement industry is the second largest market after China. Cement is a cyclical commodity with a high correlation with GDP.The Cement Industry plays a crucial role in national development growth through its contribution in the construction and development of infrastructure. The housing and real estate sector is the biggest demand driver of cement, accounting for about 65% of the total consumption in India. The other major consumers of cement include public infrastructure at 20% and industrial development at 15%.

Cement sector is an indirect beneficiary of higher government spending and any measures in the budget to improve spending augurs well for the sector. Despite elevated fiscal deficit, expectation is higher spending to spur economic growth. Overall, expectations from this year's budget are as follows:

- Higher government focus on building infrastructure including roads, airports, ports, bridges and other hard structures will increase overall cement demand. Overall Capex for the infrastructure sector likely to increase in the budget 2023. Also, rural infrastructure development through Pradhan Manti Gram SadakYojna, PradhanMantriAwasYojna (Rural), and MNREGA likely to get more funds for development. Increment in allocation of funds to government schemes will enhance cement consumption further.

- To support Real estate demand in the affordable housing segment the government should widenthe parameters under which affordable housing is defined for the various incentives provided tothis sector and increase the pricing band from Rs 45 lakh to higher amount in large metros. Theinterest deduction on housing loan should be increased from current Rs 2 lakh to Rs 3 lakh. Giveindustry status to real estate and allocate more funds to PradhanMantriAwasYojna (Urban) aresome of the budget expectations.

- Under the NIP (National Infrastructure Plan), the government has ambitious plans to develop theinfra landscape of the country. Fast-tracking of major highway projects will create more demand forcement, positively impacting cement demand.

- Transportation and logistics is a space which needs immediate attention and expectations that the budget to focus on the measures to improve and bring down the logistic cost. Lowering GST on Cement from the current 28% to a lower slab will positively impact cement consumption.

- Expects budget to facilitate and expand overall infra development which will positively benefit cement companies with higher demand.

Expansions spree likely on demand revival

Cement companies are on anexpansion spree and are expected to add 80-100 million tonnes (mt) of fresh capacity by FY25, supported by strong demand prospects. Cement demand will be driven by infrastructure upgrades, rural housing and urbanisation. The sector will see huge demand momentum with higher government spending on infrastructure owing to general elections.

India's cement demand is expected to reach 550-600 MTPA by 2025 with the housing sector accounting for about 67% of the total consumption. The other major consumers of cement are infrastructure at 13%, commercial construction at 11% and industrial construction at 9%.

With a well deleveraged balance sheet, the industry likely to add an incremental capacity of about 30-33 mt in FY23 from about 25 MTPAin FY22, with Aditya Birla Group's UltraTech Cement accounting for a chunk.

Gearing for growing demand and intense competition from new entrant Adani Group in the cement business, UltraTech Cement has drawn plans to increase its installed capacity to 159 MTPA by FY25 by adding 42 MTPA of capacity across the country along with grinding units and bulk terminals. The company's capacity has already increased 41% to 120 MTPA in the FY22 from 85 MTPA in FY18.

In May 2022, GautamAdani-led Adani Cement acquired majority stake in ACC and Ambuja Cement for $10.5 billion from Holcim AG. Ranked second and third largest, both the companies have a cumulative installed capacity of 70 MTPA.

Shree Cement, which has a production capacity of 43 mtpa, plans to add 3.5 MTPA cement capacity with an investment of Rs 3,500 crore. JK Cement plans to invest Rs 1,161 crore over the next two years to expand its capacity by 5.5 MTPA from 20 MTPA.

Dalmia Bharat has drawn aRs 9,000-crore plan to increase its cement capacity to over 48 mt by FY24 from the current 36 MTPA. In December 2022, it acquired the stressed asset of 9.4 MTPA of Jaiprakash Associates.

Cement Industry Scenario

India is the world second largest cement producer (after China) and accounts for over 8% of the global installed capacity. The three most common cement types produced in India are OPC, PPC, and PSC.

The current capacity of the Indian cement industry is ~500 million tonne per annum (MTPA) and average capacity utilization ranges between 65-70%. India's cement demand is expected to reach 550-600 MTPA by 2025, due to the increasing demand in various sectors such as housing, commercial construction and industrial construction,

India's cement industry is a vital part of its economy and employs over one million people, directly or indirectly. The industry plays a crucial role in the development of the housing and infrastructure sector of the economy.

Given the cement sector's healthy long-term growth potential, which is currentlybeing reflected in the low per capita consumption (i.e. at ~250/kg vs. global averageof ~550/kg per capita), cement demand expected to grow at a CAGR of 6-6.5% over thenext four to five years. This will be driven by good monsoon, higher farm realisationsand the government's focus on infrastructure, especially affordable housing and roadconstruction, in the run-up to general elections in India in 2024. On the cost front, therecent measures by the government (like ban on steel exports, excise duty cut ondiesel) would help in moderating the inflationary pressure. However, major costbenefit for cement companies would accrue only after structural downturn in thepetcoke/coal prices that are still trading at elevated levels.

The cement sector is likely to witness a glut of new supplies over the next three tofour yearsbased on the recent capex plan announced by majorcement companies.As per Crisil Ratings, the Indian cement industry is likely to add ~80 million tonnes (MT) capacity by FY24, the highest since the last 10 years, driven by increasing spending on housing and infrastructure activities. This would lead to fresh rounds of consolidationespecially in the mid and small sized cement players having high coststructure/bloated balance sheet. The near-term cost headwinds have already pressurisedmargins as player are unable to pass on the cost pressure due to moderation indemand in the wake of higher inflation. This has led to cement sectorunderperforming broader markets. While long-term demand is expected to stayheathy.

Thecement sector is likely to witness a subdued EBITDA/tonne in the remainder of financial year on account of continued inflationary pressures of several cost elements. The cost escalation which the sector has been experiencing since the start of 2022 has persisted as evident from the QE September 2022 results. However, there are certain green shoots indicating a probable turnaround in the upcoming quarters.

Cement demand expected to grow by 7-8% in the current fiscal (FY23), driven by the government's continued thrust on rural and affordable housing, increased allocation to infrastructure projects, revival of urban housing and commercial segment post the impact of COVID-19 over the past two years. Cement demand would also likely be boosted by the pre-election government spending ahead of the general elections in May'24.

Factors likely to aid demand:

- Urban and Rural Housing:

- Demand revival expected in real estate

- Positive momentum is likely in rural demand due to the promising rabi crop outlook

- The construction of nearly 8 million houses is likely to generate demand from the rural segment

- Infrastructure:

- 25,000 kilometres of roads are targeted in FY23

- Positive momentum is expected in urban infrastructure, Bharatmala and Metro projects

- Positive infra outlay in state Budgets

- Industrial and Commercial:

- Implementation of PLI scheme to boost the demand further

- Aggressive targets, coupled with the PLI scheme and the rising capital expenditure

- The increasing emergence of e-commerce and retail would likely push demand for warehouse

- The government's aim of 220 airports by 2025 would further boost the demand

The budgetary allocation of over Rs 9.2 lakh crore towards agriculture, affordable housing, and capital expenditure is expected to augur well for cement demand. The cement demand is expected to grow by 7-8% in FY2023 supported by strong demand from rural housing and infrastructure sectors.

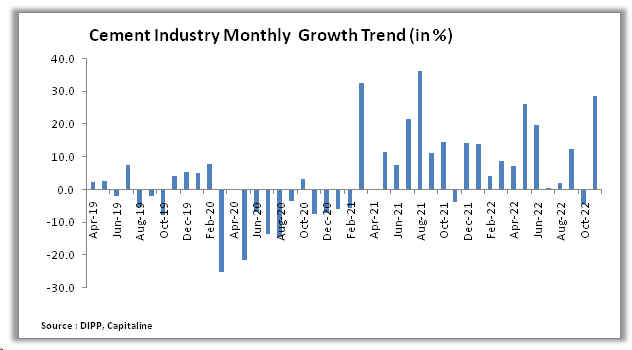

Cement Industry output rebounds 28.6%inNovember2022

All-India cement production (proxy for demand), as reported by the Office of Economic Advisor, Ministry of Commerce and Industry, increased28.6% to 31.07lakh tonnes in November 2022 over a year and higherby 5.7% over October 2022.

For April-November period of FY 2023, cement production increased by 10.8% to 2482.87 lakh tonnes. Cement production increased by 20.9% to 3,562.04 lakh tonnes in FY2022 as compared cement production de-growth of 11.9% to 2,945.22 lakh tones in FY 2021, de-growth of0.9% to 3,343.66 lakh tonnes in FY 2020, growth of 13.3% to 3,373.22 lakh tones in FY2019, and growth of 6.3% to 2,977.11 lakh tonnes in the FY2018.

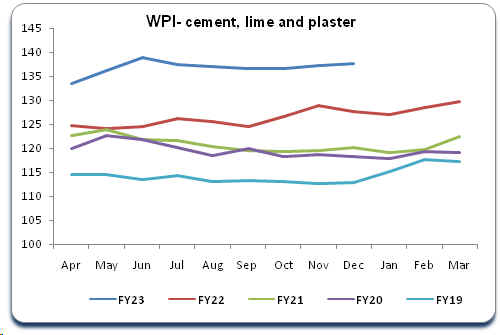

Cement WPI for December 2022

The Cement, Lime and Plaster Wholesale Price Index (WPI), with a weight of 1.644 in the WPI, inclined 7.8% to 137.6 in December 2022 over a year and up by0.2% over month.

For April-December period of FY 2023, Cement, Lime and Plaster WPI growth was up 8.7%. Cement, Lime and Plaster WPI growth was up 4.7% for FY2022 as compared to growth of 1.1% in FY2021, growth of 4.6% in FY 2020, growth of 0.5% in FY2019, growth of 2.9% in FY2018, and growth of 0.6% in FY2017.

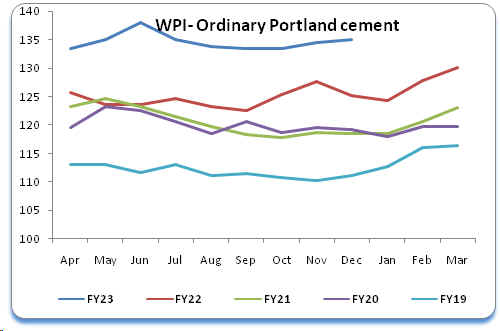

Meanwhile, the Ordinary Portland cement WPI, with a weight of 0.852 in the WPI, rose 7.8% at 135 in December 2022 over the year and up by 0.4% over the month.

For April-December period of FY 2023,Ordinary Portland cement WPI grew 8%. it was up 3.9% in FY2022 as compared to growth of 0.5% in FY2021, growth of 6.6% in FY2020, growth of 1.1% in FY 2019, growth of 3.3% in FY2018, and growth of 0.8% in FY2017.

Outlook

Cement companies are on an expansion spree and are expected to add 80-100 million tonnes (mt) of fresh capacity by FY25, supported by strong demand prospects. Theindustry is likely to add an incremental capacity of about 30-33 mt in FY23 from about 25 MTPAin FY22. Cement demand will be driven by infrastructure upgrades, rural housing and urbanisation. The sector will see huge demand momentum with higher government spending on infrastructure owing to general elections.

India's cement demand is expected to reach 550-600 MTPA by 2025 with the housing sector accounting for about 67% of the total consumption. The other major consumers of cement are infrastructure at 13%, commercial construction at 11% and industrial construction at 9%.

Thecement industry dynamics looks positive given better demand prospects, because of the consolidation in the sector, considerable pick up in the activity both from the government side as well as from the private side in terms of construction, real estate and related activities which is definitely extremely good.

The cement demand expected to record a growth of ~10-11% in FY23 and ~9% FY24, driven by the government's continued thrust on rural and affordable housing, increased allocation to infrastructure projects, revival of urban housing and commercial segment post the impact of COVID-19 over the past two years. Cement demand would also likely be boosted by the pre-election government spending ahead of the general elections in May'24.

With the recovery in prices on the anvil and cool off in certain commodity prices and petcoke price in particular, the margins are set to rebound.

|