|

A late pick up in monsoon rains has pushed up the local sowing activity. The Department of Agriculture & Farmers' Welfare has released progress of area coverage under kharif crops as on 21st July 2023. The acreage under leading crop Rice has gone up by 2.70% on year to 180.20 lakh hectares. Pulses area is down around 10% to 85.85 lakh hectares while acreage under oilseeds is up 3.30% to 160.41 lakh hectares. Area under coarse cereals is at 134.91 lakh hectares, up 4.78%. Sugarcane area is up 5% to 56 lakh hectares. Area under cotton is flat at 109.69 lakh hectares. Total kharif crop area is up marginally by 1.16% to 733.42 lakh hectares. This can show a further improvement in coming weeks and will likely determine the demand for agrochemicals and fertilizers.

India is one of the leading players in the global agriculture sector. Our nation is the world's largest producer of pulses and spices and has the most land planted to wheat, rice, and cotton. It is the second-largest producer of rice, wheat, cotton, sugarcane, and fruits and vegetables. Agriculture sector in India holds the record for second-largest agricultural land in the world generating employment for about half of the country's population. The Indian agricultural sector is predicted to increase to US$ 24 billion by 2025 and rapid population expansion in India is the main factor driving the industry.

Agrochemical is a generic term used for the various chemical products typically used in agriculture. Agrochemicals or crop protection chemicals are essential for the progress of Indian agriculture. We all know that agrochemicals in combination with genetically improved varieties of crop species have played a huge role in the success of the green revolution. Apart from preventing crop losses, the reasonable usage of these chemicals is essential to ensure sustainable agriculture practices. India is the world's fourth-largest agrochemical producer and a net exporter. It has been estimated that our agrochemical market will reach $8.1 billion by 2025. Given huge untapped potential along the value chain, the industry has significant potential for growth.

Broad Outlook Supportive

The macro-environment for the agrochemicals industry in India is expected to remain positive and be driven by fundamental solid growth, rising domestic demand, improved export opportunities, tie-ups with innovators for new products, and substantial prospects to explore products off-patent. The domestic market is dominated by insecticides, accounting for 60% of overall demand, followed by fungicides and herbicides. The industry has witnessed significant investment and mergers and acquisitions, helping Indian companies reduce research and development costs and development time and improve efficiency in the R&D process.

Despite the potential and the crucial role played by the agrochemical industry, it faces several challenges that hinder its growth and profitability. One of the significant issues is the slow pace of the registration process for new molecules, leading to high R&D and time costs. To thwart this challenge, the government and regulatory authorities must intervene to streamline the registration process and ensure that registration is granted within one year.

Another issue confronting the sector is the increasing cost of raw materials. India imports nearly 50% of its technical grade requirement from China, which pressures margins due to macroeconomic factors and high inventory resulting from seasonal demand. This necessitates government intervention focusing on creating cluster areas for the chemical industry to manufacture technical-grade raw materials under the "Make in India" program.

Agrochemicals market share consist of tier I, tier II, and local players, which makes the worldwide market quite competitive. The market is flooded with items from manufacturers, such as fertilizers with increased potency and pesticides like herbicides, rodenticides, fumigants, insecticides, fungicides, and plant growth regulators. Players compete against one another based on a variety of factors, such as product quality, costs, and services, as well as on innovation, sustainability, and corporate reputation. The main approaches used by businesses to increase their market share include joint ventures, M&As, distribution network and geographic expansions, and the introduction of new products also

Key players in the Agrochemical sector

UPL Ltd

UPL is principally engaged in the agro business of production and sale of agrochemicals, field crops, vegetable seeds and non-agro business of production and sale of industrial chemicals, chemical intermediates, specialty chemicals.

P I Industries Ltd

PI Industries is in the field of Agri Sciences having strong presence in both Domestic and Export market.

Sumitomo Chemical India Ltd

Sumitomo Chemical India is primarily engaged in manufacturing and sales of household insecticides, agricultural pesticides, public health insecticides and animal nutrition products.

Bayer CropScience Ltd

Bayer CropScience is engaged in ‘Agri Care' business which primarily includes manufacture, sale and distribution of insecticides, fungicides, herbicide and various other agrochemical products and corn seeds. The Company is also involved in sale and distribution of hybrid seeds.

Sharda Cropchem Ltd

Sharda Cropchem is principally engaged in export of agrochemicals (technical grade and formulations) and non-agro products such as conveyor belts, rubber belts/sheets, dyes and dye intermediates to various countries across the world.

Rallis India Ltd

Rallis India is engaged primarily in the business of manufacture and marketing of Agri Inputs. The Company has its manufacturing facilities in India and sells both in India and across the globe.

Bharat Rasayan Ltd

Bharat Rasayan is a backward integration project to manufacture Technical Grade Pesticides and Intermediates confirming to International Standards.

Dhanuka Agritech Ltd

Dhanuka Agritech is engaged in manufactures a wide range of agro-chemicals like herbicides, insecticides, fungicides, plant growth regulators in various forms - liquid, dust, powder and granules.

Astec Life sciences Ltd

Astec Life sciences is engaged to manufactures a wide range of Agrochemical active ingredients and pharmaceutical intermediates. The business of the company comprises of the two major segments, namely Agrochemicals and Pharmaceuticals. Under the Agrochemical segment, the company manufactures active ingredients, intermediates and formulations. Active ingredients are sold to crop protection formulators. Intermediates are supplied to technical grade product manufacturers

Best Agrolife Ltd

Best Agrolife The Company is a leading agrochemicals manufacturer and is among the top 15 agrochemicals companies. It is one of the fastest growing manufacturers of Technical, Formulations, Intermediates and Public Health products. The Company is recognized for its niche product category which promotes sustainable agriculture by delivering high quality, modern, innovative and cost-effective crop protection solutions to farmers across the globe

India Pesticides Ltd

India Pesticides is engaged in ‘Agri Chemicals' business which primarily includes manufacture, sale and distribution of insecticides, fungicides, herbicide and various other agrochemical products.

Meghmani Organics Ltd

Meghmani Organics is engaged in manufacturing and selling of pigment and agrochemicals products.

Financial Performance of Agrochemical companies in India

| Company |

Year End |

Net Sales |

RPAT |

Year End |

Net Sales |

RPAT |

SALES % |

PAT % |

Market Cap |

| P I Industries |

202303 |

1506.4 |

279.4 |

202203 |

1349.5 |

204.6 |

11.63 |

36.56 |

58488.85 |

| UPL |

202303 |

3581 |

-163 |

202203 |

4326 |

703 |

-17.22 |

-123.19 |

50275.7 |

| Sumitomo Chemi |

202303 |

651.57 |

72.47 |

202203 |

664.04 |

74.71 |

-1.88 |

-3 |

22406.65 |

| Bayer Crop Sci. |

202303 |

982.5 |

158.5 |

202203 |

963.3 |

152.7 |

1.99 |

3.8 |

20581.68 |

| ShardaCropchem |

202303 |

1292.23 |

210.89 |

202203 |

1232.15 |

131.62 |

4.88 |

60.23 |

4997.76 |

| Rallis India |

202303 |

522.62 |

-69.13 |

202203 |

507.54 |

-14.13 |

2.97 |

389.24 |

4090.65 |

| Bharat Rasayan |

202303 |

305.88 |

32.61 |

202203 |

444.78 |

64.54 |

-31.23 |

-49.47 |

3954.59 |

| DhanukaAgritech |

202303 |

371.23 |

65.31 |

202203 |

318.3 |

54.29 |

16.63 |

20.3 |

3602.05 |

| AstecLifescienc |

202303 |

126.97 |

-5 |

202203 |

271.98 |

43.04 |

-53.32 |

-111.62 |

2672.45 |

| Best Agrolife |

202303 |

259.8 |

-32.44 |

202203 |

258.13 |

21.56 |

0.65 |

-250.46 |

2611.92 |

| India Pesticides |

202303 |

198.18 |

30.17 |

202203 |

177.34 |

30.82 |

11.75 |

-2.11 |

2551.45 |

| MeghmaniOrgani. |

202303 |

564.63 |

45.08 |

202203 |

813.37 |

106.98 |

-30.58 |

-57.86 |

2215.08 |

Data from Capitaline Database

All Values in Rs Cr.

Data Data from Capitaline Database All Values in Rs Cr.

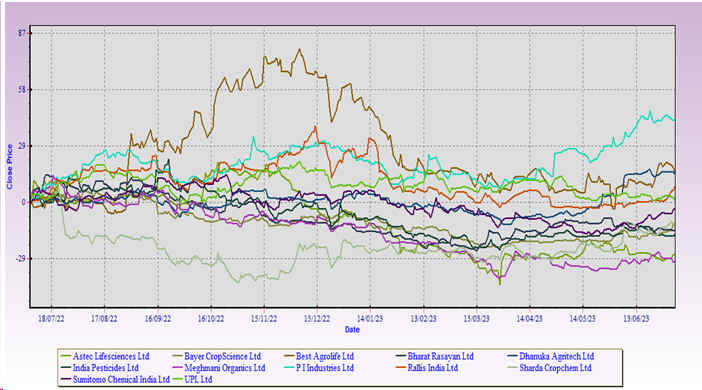

Price Movement of Agrochemical Sector Stocks

Data from Capitaline Database

PRANAM scheme to promote use of nutrient-based bio fertilizers

The Cabinet Committee on Economic Affairs (CCEA) recently approved the PM-PRANAM (PM Programme for Restoration, Awareness, Generation, Nourishment and Amelioration of Mother Earth) scheme. Union Fertilizer Minister Mansukh Mandaviya said that the new scheme would promote use of nutrient-based, bio fertilizers for sustainable agriculture and it would have a total outlay of Rs 3,70,128.7 crore.

The PM-PRANAM scheme was aimed at saving the soil and promote sustainable, balanced use of fertilizers and it involved the participation of State governments, Mandaviya said. He said the Centre would incentivize those States which would adopt alternative fertilizers with the subsidy that was saved by reducing the use of chemical fertilizers. Mandaviya said if a State was using 10 lakh tonnes of conventional fertilizers and reduces its consumption by three lakh tonnes, then the subsidy saving would be Rs 3,000 crore. Out of that subsidy savings, the Centre will give 50% of it — Rs 1,500 crore to the State for promoting the use of alternative fertilizer and other development works," the Minister added. Mandaviya said the use of nano urea had also increased in the country. By 2025-26, eight nano urea plants with production capacity of 44 crore bottles, equaling to 195 lakh tonnes of conventional urea, will be commissioned.

Outlook:

The Centre said that the PRANAM scheme included a bouquet of various schemes which would boost farmers' income, strengthen natural / organic farming, rejuvenate soil productivity, and ensure food security. The CCEA also approved continuation of the urea subsidy scheme to ensure constant availability of urea to the farmers at the same price of Rs 242/ 45 kg per bag. Meanwhile, the overall tempo in the demand for fertilizers is looking choppy in the near term due to the delayed start to the kharif sowing. Not only fertilizer this will also decrease the demand and use of Agrochemical use by the farmers and if use of these type chemical is decreasing day by day it will improve the soil quality which is badly effected by chemical based fertilizers if use is decreased this will affect the production and sales values of the industry which is not looking good for the industry. The trend in agrochemical consumption will likely also be determined by the movement in food prices in the country over coming months. The WPI Food Index, which includes food articles from the primary articles group and food products from the manufactured products group, increased from 172.8 in May 2023 to 175.2 in June 2023. The annual rate of inflation based on the WPI Food Index changed from -1.59% in May 2023 to -1.24% in June 2023. Food prices need to stabilize in near term in order to provide a tilt the growers and in turn support the demand for agrochemicals and other farming inputs.

|