Date: 29 Sep 2023

Cement - Products

Sector |

Market Cap |

No of Companies |

Cement - Products |

8200.35 |

8 |

NetWorth |

6555.93 |

TTM Sales |

8349.42 |

TTM Sales Var (%) |

-0.19 |

Debt |

1327.41 |

TTM OP |

526.12 |

TTM NP Var (%) |

-39.58 |

Capital Employed |

8122.70 |

TTM OPM (%) |

7.72 |

EV/TM Sales |

0.98 |

Net Block |

2876.79 |

TTM PATM (%) |

3.15 |

EV/TTM EBITDA |

17.76 |

Current Assets |

3245.60 |

Debt / Equity |

0.20 |

P/E |

31.14 |

ROCE (%) |

14.06 |

RONW (%) |

4.02 |

P/B |

1.25 |

The above figures are in Rs. Crores as of 29 Sep 2023

TTM ended June 2023

|

29 Sep 2023 |

31 Aug 2022 |

31 Aug 2021 |

MoM Var. (%) |

YoY Var. (%) |

Sector Marketcap |

8200.35 |

8222.87 |

9646.76 |

-0.27 |

-14.99 |

Total Marketcap |

32073208.11 |

28153731.53 |

26224238.3 |

13.92 |

22.3 |

Sector's share |

0.03 |

0.03 |

0.04 |

0 |

-0.01 |

Sector No of companies |

8 |

8 |

7 |

0 |

1 |

Total Listed companies |

4410 |

4144 |

4017 |

266 |

393 |

Sector's share |

0.18 |

0.19 |

0.17 |

-0.01 |

0.01 |

Nifty 50 |

19638.3 |

19253.8 |

17094.35 |

2 |

14.88 |

Gainers |

| Company Name |

29/09/2023 |

29/08/2023 |

Var% |

| Kanoria Energy |

33.70 |

21.88 |

54.02 |

| Visaka Industrie |

91.35 |

87.79 |

4.06 |

| Sahyadri Industr |

439.30 |

424.00 |

3.61 |

| Ramco Inds. |

180.95 |

177.90 |

1.71 |

| BIGBLOC Const. |

166.65 |

166.30 |

0.21 |

Losers |

| Company Name |

29/09/2023 |

29/08/2023 |

Var% |

| Vardhman Concr. |

6.50 |

7.70 |

-15.58 |

| Everest Inds. |

1099.75 |

1211.15 |

-9.20 |

| Hil Ltd |

2856.45 |

2924.05 |

-2.31 |

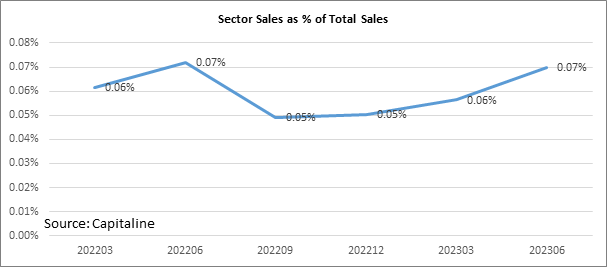

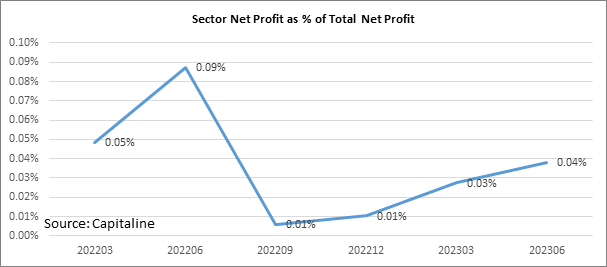

During the month of September 2023, Cement - Products sector’s Marketcap decreased -0.27% to Rs 8200.35 crore, compared to 13.92% rise in total listed marketcap to Rs 32073208.11 crore.

Sector’s share of total listed marketcap moved to 0.03% in September 2023 from 0.03% in August 2022 and 0.04% in August 2021.

In terms of price appreciation in the sector, there were 5 gainers and 3 losers in the month of Sep 2023. The gainers accounted for 62.50% of sector companies, losers accounted for 37.50% of sector companies.

The top 3 gainers were Kanoria Energy (54.02% gain), Visaka Industrie (4.06% gain) and Sahyadri Industr (3.61% gain).

The 3 losers at the bottom were Vardhman Concr. (-15.58% fall), Everest Inds. (-9.20% fall) and Hil Ltd (-2.31% fall).

BIGBLOC Construction Ltd and Kanoria Energy & Infrastructure Ltd became ex-dividend.

During the month Everest Industries Ltd, Hil Ltd, Visaka Industries Ltd, Ramco Industries Ltd, Kanoria Energy & Infrastructure Ltd, Vardhman Concrete Ltd, Sahyadri Industries Ltd and BIGBLOC Construction Ltd filed their shareholding patterns.

FIIs reduced their shareholding in Everest Industries Ltd from 10.67% to 10.63%, BIGBLOC Construction Ltd from 0.05% to 0.00%, Hil Ltd from 2.79% to 2.55%, Ramco Industries Ltd from 1.16% to 0.73% and Visaka Industries Ltd from 3.81% to 3.20%.

Promoters reduced their shareholding in Everest Industries Ltd from 50.42% to 50.39% and Vardhman Concrete Ltd from 61.10% to 61.02%.

During the month Annual reports of Everest Industries Ltd, Hil Ltd, Visaka Industries Ltd, Ramco Industries Ltd, Singhal Cement & Allied Industries Ltd, SWP(Madras) Ltd, U.P.Asbestos Ltd, Kanoria Energy & Infrastructure Ltd, Vardhman Concrete Ltd, Siporex India Pvt Ltd, Lok Cement Ltd, ACC Mineral Resources Ltd, Talavadi Cements Ltd, Tapi Prestressed Products Ltd, Sahyadri Industries Ltd, Sree Jayajothi Cements Ltd, Ujala Merchants & Traders Ltd, Hills Cement Company Ltd, Enviiro Buildmate Pvt Ltd, Manchukonda Prakasham Industries Pvt Ltd, BIGBLOC Construction Ltd, Magicrete Building Solution Pvt Ltd, Roxul Rockwool Technical Insulation India Pvt Ltd, Roxul-Rockwool Insulation India Pvt Ltd, Ashoka Pre-con Pvt Ltd, Patel Concrete & Quarries Pvt Ltd, RMC Readymix Porselano India Ltd, Adani Cementation Ltd, Walplast Products Pvt Ltd and Aakaash Manufacturing Co. Pvt Ltd were updated in Capitaline.